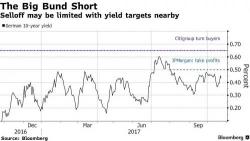

What Selloff: Futures Rebound, Nikkei Extends Record Winning Streak

European shares are modestly lower as investors monitor tense events in Spain and as focus turns to Thursday’s ECB meeting; US equity futures have rebounded from yesterday's sharp but shallow selloff and are in the green amid rising odds of U.S. tax reform and the imminent unveiling of the next Fed chair while Asian shares rise and Japan extends its winning streak to a record 16 days. The euro edged higher after data showed Europe’s economy is maintaining momentum, while the USDJPY managed to recover all of yesterday's sharp losses.