Nordstrom Plunges After Suspending 'Going-Private' Explorations

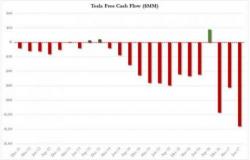

Nordstrom shares are tumbling uin the pre-open (down over 5% to 3-month lows) as the company temporarily suspends its explorations for going-private, citing "difficulties in obtaining debt financing."

As Bloomberg reports, Nordstrom family plans to continue efforts after holiday season with management set to maintain focus on execution of business plan for year-end period.

And the result is the erasure of all post-rumor-gains and then some...