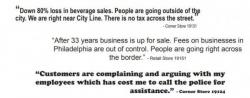

Philly Admits Soda Tax Is Crushing Local Small Businesses, Expanding "Food Deserts"

Just one week after Chicago shockingly repealed their soda ban following a revolt from local business owners (see: Soda Tax Fizzles In Chicago As Cook County Officials Cast Decisive 15-1 Repeal Vote), it seems that Philadelphia's flirtations with forming a more perfect "nanny state" via the elimination of sugary drinks could be on a collision course with a similar fate.