Dow Futures Over 23,000: Dollar, Global Stocks Jump As China Congress Begins

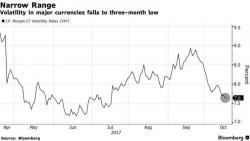

World stocks stayed near peaks and currencies moved in tight ranges on Wednesday as China’s 19th Communist Party Congress opened while focus in Europe turned to speeches from top euro zone central bankers before next week’s key policy meeting, as well as Catalonia's ultimatum due on Thursday. S&P futures are solidly in the green as usual, with Dow futures jumping above 23,000, driven higher by IBM as investors looked for new reasons to extend gains after hitting new all-time highs Tuesday.