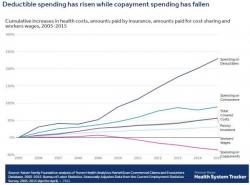

Employer-Sponsored Healthcare Deductibles Surge 400% In Past Decade; 13x More Than Wages

We spend fair amount of time discussing the soaring costs of Obamacare, but, as the Kaiser Family Foundation points out in a new study, employer sponsored plans, while not as bad as Obamacare, are also gradually pushing more healthcare costs onto their employees through surging deductibles and co-insurance payments all while wages remain fairly stagnant.