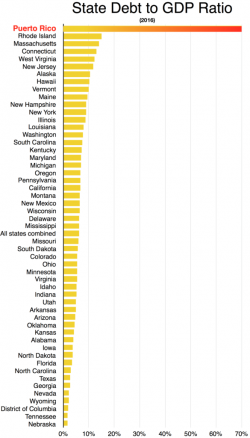

The Case For Wiping Out Puerto Rico's Debt

Authored by Tom Sanzillo via ValueWalk.com,

President Trump, who knows a thing or two about bankruptcy, says Puerto Rico’s public debt should be wiped out. We agree.

The commonwealth owes bondholders somewhere on the order of $70 billion, with most of that debt tied to general-obligation bonds, revenue bonds and bonds issued by the Puerto Rico Electric Power Authority (PREPA).