Dutch Central Bank Warns Of Market Calm Before The Storm:

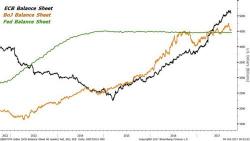

With one foot out of the door of Germany's finance ministry, the former head of the German economy, Wolfgang Schäuble, 75, delivered a fire and brimstone warning over the weekend, telling the FT in an interview that there was a danger of "new bubbles" forming due to the trillions of dollars that central banks have pumped into markets. Schäuble also warned of risks to stability in the eurozone, particularly those posed by bank balance sheets burdened by the post-crisis legacy of non-performing loans, something we warned about since 2012, and an issue which remains largely unresolved.