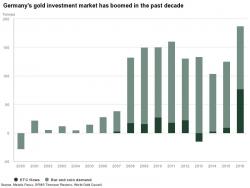

Gold Investment In Germany Surges – Now World’s Largest Gold Buyers

Gold Investment In Germany Surges – Now World’s Largest Gold Buyers

Gold Investment In Germany Surges – Now World’s Largest Gold Buyers

In his latest Macro View, Bloomberg reporter and macro commentator, David Finnerty, explains why investors are better off ignoring today's payrolls report - where "any weakness will be attributed to hurricanes, while a beat on payrolls or wages would be seen as supporting a Federal Reserve interest rate increase in December" - and instead focus on Europe, and specifically the next ECB meeting which will set the stage for the next big move in global risk.

His full note below.

Looking for the Next Treasury Driver After Payrolls

No matter what Jamie Dimon may say, bitcoin’s durability can be expressed by one simple fact: With a market cap of $100 billion, digital currencies have become too big for banks to ignore.

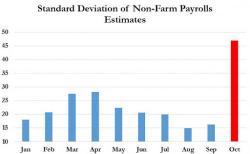

Tomorrow's hurricane-affected September jobs report will be... confusing. That is the (lack of) consensus from Wall Street analysts, who expect an average print of 80,000 (down from the 3-month average of 185K), however with huge variance on either side, with 4 economists predicting a loss of jobs, three expecting a print higher than 150K and one optimistic forecaster going as high as 260,000.

The amusing breakdown by bank is as follows:

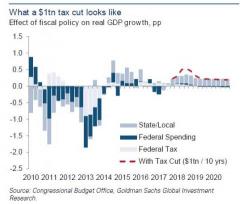

Today The House passed the 2018 budget resolution in a 219-207 mostly party-line vote (18 republicans voted against the resolution along with all Democrats), representing the first step toward the Republican goal of sending tax-reform legislation to President Trump.