Hyperbitcoinization? Bitcoin Trades At 85% Premium In Zimbabwe - Priced At $7,200

While bond notes were put forward as a panacea to diminish the flight of wealth from Zimbabwe... (as Steve Hanke noted, it was not)...

While bond notes were put forward as a panacea to diminish the flight of wealth from Zimbabwe... (as Steve Hanke noted, it was not)...

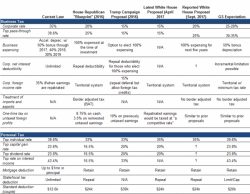

Just hours before the Trump tax plan was leaked this morning, Goldman noted that "even if this tentative budget agreement in the Senate becomes official the forthcoming proposal would have to be scaled substantially to fit within the fiscal constraints Congress is likely to impose" which we summarized as follows:

In other words, for all the hype, the final Trump tax cut - if it passes - will be a pale shadow of its initial proposal

Goldman also presented the following comparison table to summarize how the expected plan would fare in context:

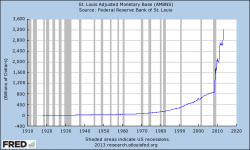

As ZeroHedge readers are keenly aware, 2008 kicked off the largest financial engineering experiment in history – namely, the beginning of 12.3 Trillion in QE and the lowest interest rates in 5,000 years. The plan, hatched by Bush-era Fed Chairman Ben Bernanke and Treasury Secretary Hank Paulson, created a ‘Fed Put’ underneath the markets first made popular by Alan Greenspan – an implicit guarantee that no matter how bad things got, the Fed would actively combat financial disaster.

The ONLY Variable That Matters To The Price Of Gold

Written by Jeff Nielson, Sprott Money News

There are all sorts of positive fundamentals when it comes to the price of gold. There are the positive supply/demand fundamentals. The gold market is in a supply deficit. Mine reserves are at a 30-year low. The price of gold is below what is necessary to sustain the gold mining industry.

Authored by Raul Ilargi Meijer via The Automatic Earth blog,

You would think, certainly if you were as naive and innocent as I am, that when you get offered the job of Chair of the Federal Reserve, you must be sure, before accepting, that you have the credentials and the knowledge required. If you don’t, it looks as if you don’t take the job seriously. Janet Yellen, who’s been Chair since January 2014, doesn’t seem to agree.