VIXtermination Sparks Buying-Panic In Stocks As Yield Curve Crashes To 10 Year Lows

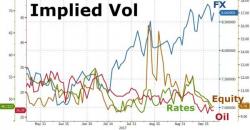

A chaotic week in some markets...

But only FX sees through the bullshit...

It was a week of superlatives...

Trump's best week of the year...

A chaotic week in some markets...

But only FX sees through the bullshit...

It was a week of superlatives...

Trump's best week of the year...

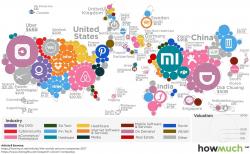

Today’s infographic comes to us from cost information site HowMuch.net, and it shows the hundreds of unicorns around the world. The special “unicorn” moniker, of course, is reserved for privately-held startups that reach valuations of a billion dollars or more.

In this map, the startups are plotted plotted based on their country of origin, and not their physical geographic location (such as a specific city or state). Further, companies are organized also based on color, which represents the spectrum of sectors that these startups span across.

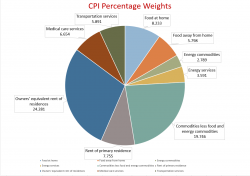

As if inflation wasn't "mysterious" enough to the Fed already, today the New York Fed joined the Atlanta Fed first in releasing its own measure to track underlying inflation called, simply, the Underlying Inflation Gauge. What is notable is that this latest inflation tracker shows prices behaving quite differently from traditional indexes this year.

As we have hammered away at for years, "the math doesn't work", and it appears The Fed just admitted it.

In a stunning admission that i) US economic potential is lower than consensus assumes and ii) that the Fed is finally considering the gargantuan US debt load in its interest rate calculations, moments ago the Fed's Kaplan said something very surprising:

Authored by Mike Shedlock via MishTalk.com,

The amount of sheer nonsense written about inflation expectations is staggering.

Let’s take a look at some recent articles before making a mockery of them with a single picture.

Expectations Problem

On July 17, 2017, Rich Miller writing for Bloomberg proclaimed The Fed Has an Inflation Expectations Problem.