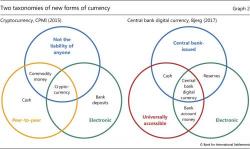

In Scramble To Explain Bitcoin, BIS Unveils "A New Taxonomy Of Money" In Three Charts

New cryptocurrencies are emerging almost daily, and many interested parties are wondering whether central banks should issue their own versions. But what might central bank cryptocurrencies (CBCCs) look like and would they be useful? This feature provides a taxonomy of money that identifies two types of CBCC - retail and wholesale - and differentiates them from other forms of central bank money such as cash and reserves.