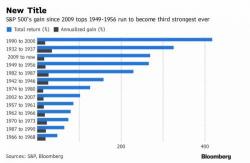

S&P On The Verge Of History

U.S. stocks have risen more in the past eight years than in almost any other post-World War II time of economic growth, as defined by the National Bureau of Economic Research.

The logic here is that economic expansions fuel bull markets and so it’s reasonable to measure market recoveries after a period of macro contraction ends.