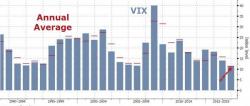

VIX Set For Lowest Annual Average Ever, But...

While intra-month the CBOE Volatility Index reached its highest since November, before plunging back to earth into the end of the month, VIX is still on track to post its lowest annual average on record.

Bloomberg notes that in the past decade, VIX gains in August were followed by September declines in all but one instance.

While VIX has collapsed so far this year, it may not last.