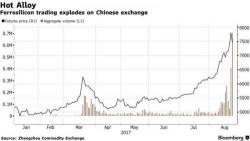

Inside The "Wildest Commodity Trade" Ever... Just Don't Blink

Besides the hilariously fabricated economic data and the whole central planning bit - both of which are now everywhere these days - the one most notable feature about China's economy and capital markets are the constantly rolling, bursting and resurrecting asset bubbles: from housing, to stocks, to bonds, to commodities, to cryptocurrencies, to pretty much anything that isn't nailed down and can be traded, and back to housing again, the lifecycle of a Chinese assets is best expressed in terms of its "tulipness": how long before the swarming horde of Chinese bubble-chasers, armed wi