Stocks, Dollar & Yields Sink After Fed Warns Of "Elevated Vulnerabilities" From High Asset Prices

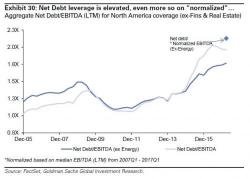

The initial reactions wre modest but directionally 'correct' given the dovish bias to the Fed Minutes - stocks are up, bonds are up (lower in yield), and the dollar is down. But then traders read the warnings that due to excessively easy financial conditions, "a tighter monetary policy than otherwise was warranted", something Goldman has been warning about for months, and stocks sank.

To be sure, there were 3 very dovish quotes: