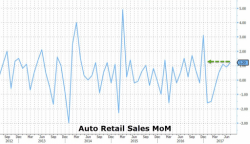

One Analyst Throws Up On Today's Retail Sales Data: Here's Why

Two weeks ago we reported that July auto sales were a disaster: recall sales for bloated with inventory GM were down 15% YoY, Ford off 7% and Chrysler down 11% - despite record incentive spending - as overall auto sales declined and disappointed for yet another month. And yet, according to this morning's retail sales report from the Census Bureau, sales for "motor vehicle & parts stores" rose much more robustly than anyone had anticipated, rising 1.2%, the fastest pace since December.