Let Banks Manage Risks, Not Regulators

Authored by Steve H. Hanke of the Johns Hopkins University. Follow him on Twitter @Steve_Hanke.

Authored by Steve H. Hanke of the Johns Hopkins University. Follow him on Twitter @Steve_Hanke.

Authored by Valentin Schmid via The Epoch Times,

There are few entertaining economists, and fewer still work on Wall Street. Willem Buiter, the chief economist of Citigroup, is one of them. He is not only entertaining, but also outspoken—and his analysis of key economic trends and themes is second to none.

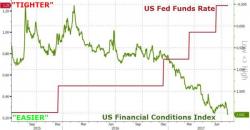

The Epoch Times spoke with Buiter about Federal Reserve (Fed) interest rate policy and the surprising strength of the euro, as well as the impossibility of a Chinese soft landing.

Authored by Gilbert Berdine via The Mises Institute,

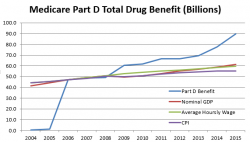

Enter “outrageous drug prices” into Google and you will receive plenty of examples. As reported here, Marathon Pharmaceuticals planned to charge $89,000 per year for its Emflaza brand of the corticosteroid deflazacort. Deflazacort was introduced in 1969 and is available outside the U.S. for less than $2 per tablet. US patients with muscular dystrophy have been obtaining the drug for around $1,500 per year from foreign sources.

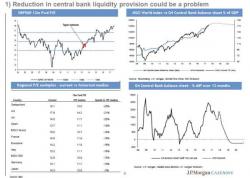

While most banks have in recent weeks expressed concerns about the recent, near record high levels in the S&P - which is now 67 points above Goldman's year end price target of 2,400 - few have been willing to go out on a limb and announce they are short the market, and that the bull market is now over (unlike Gartman who on Friday staked his reputation that the "Bull market has come to an end" only to unleash another rally in the S&P in the next two days).

Authored by Wolf Richter via WolfStreet.com,

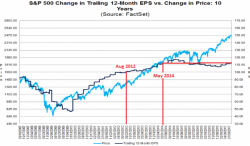

Are we blinded yet by the brilliance of corporate earnings?

“Adjusted” earnings growth is 10.2% year-over-year in the second quarter, according to FactSet, based on the 91% of the companies in the S&P 500 that have reported results. The energy sector was a key driver, with 332% “adjusted” earnings growth from the oil-bust levels of a year ago.