CHiCKeN RaCe 2017...

h/t: pistolnation.com

.

.

h/t: pistolnation.com

.

.

Blame The Russians, The Chinese, The North Koreans, and The Welsh... but not The Fed...

Overnight saw more China turmoil.. (MSCI China ETF saw its biggest drop since Brexit)

Authored by MN Gordon via EconomicPrism.com,

“Markets make opinions,” goes the old Wall Street adage. Indeed, this sounds like a nifty thing to say. But what does it really mean?

Perhaps this means that after a long period of rising stocks prices otherwise intelligent people conceive of clever explanations for why the good times will carry on. Moreover, if the market goes up for long enough, the opinions become so engrained they seek to explain why stock prices will go up forever.

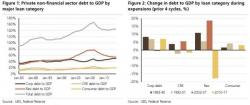

Several weeks ago, Janet Yellen boldly declared "I don't believe we will see another crisis in our lifetime." For the rest of us who live in reality there is little doubt that the latest Fed-fueled credit bubble will eventually burst in epic fashion and once again lay waste to the personal balance sheets of millions of Americans. And while the timing of market collapses can never be predicted, UBS strategist Matthew Mish says there is one thing that is certain about the next credit unwind, it will be unlike anything we've seen before.

There's covenant-lite and then there's "zero covenant" junk debt, and moments ago Tesla just sold $1.8 billion of the former, upsizing what was previously expected to be a $1.5 billion issue. The deeply junk "B3/B-" rated bond was priced at par to yield 5.25%, with Goldman - who famously slashed its Tesla price target to $180 a month ago - as lead left. It was unclear how many times the offering was oversubscribed but one guess offered was "many."

The details from Bloomberg: