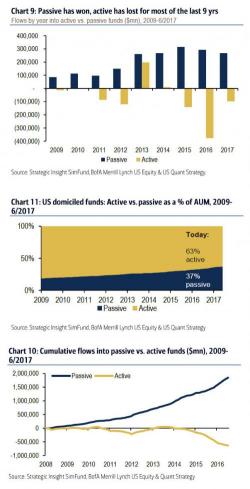

How Passive Investing Distorts Earnings Season

In a spirited defense of today's inefficient market, one which is allegedly unimpaired by the relentless metastasis of passive investing, Bloomberg wrote an article using Macro Risk Advisors data, in which it said that "for all the handwringing about how the growth of passive investing strategies is distorting the stock market" it concluded that "there’s virtually no market impact from it. Correlations remain at all-time lows and the amount of shares that are passively managed isn’t affecting single-stock."