Nasdaq Limps To Best Run Since Feb 2015 As Bitcoin Surges Most In 13 Months

Despite Bank of Japan and ECB talk, and thanks to a tanking VIX, the new normal of utter tranquility in markets continued...

Soft Data rolled over again today...

Despite Bank of Japan and ECB talk, and thanks to a tanking VIX, the new normal of utter tranquility in markets continued...

Soft Data rolled over again today...

Authored by David Stockman via The Daily Reckoning,

It’s all over now except the shouting about Obamacare repeal and replace, but that’s not the half of it.

The stand by Senators Lee and Moran was much bigger than putting the latest iteration of McConnell-Care out of its misery. The move rang the bell loud and clear that the Imperial City has become fiscally ungovernable.

Yesterday we warned of the growing anxiety in short-term Treasury-Bill markets over the looming debt-ceiling. Today, the tension has worsened with the 10/19 bill now up a shocking 13bps in 3 days leaving the curve extremely inverted around the potential debt-ceiling deadline.

As Bloomberg notes, short-term investors aren’t waiting for Treasury Secretary Steven Mnuchin to inform Congress of the exact date the U.S. will run out of cash.

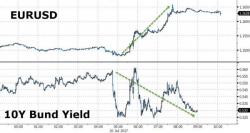

As the world watched with bated breath for any dovish tilt from Draghi this morning, RBC's head of cross-asset strategy Charlie McElligott laid out his game-plan. While the EUR is higher (hawkish), bund yields are lower (dovish) McElligott warns the cozy calm 'status quo' could get a rude interruption in the fall...

Having not quite got the reaction he wanted, leaks were implemented to force the dovish tilt...

So as McElligott wrote earlier:

Authored by Mike Shedlock via MishTalk.com,

Inquiring minds may be wondering what economic cartoons from 1912 looked like. I can help.

It seems silly now, but in 1912 some nuts thought the Fed would become an all-powerful Wall Street/Bank/Gov't cartel. pic.twitter.com/rFjCf4KElx

— Rudolf E. Havenstein (@RudyHavenstein) February 22, 2014