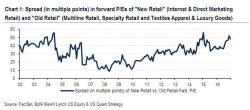

The Difference Between "Old" And "New" Retail? A Record 50x PE Turns

In the battle between "old" (bricks and mortar) and "new" (online) retail, few will survive although according to the market, the winner couldn't be more clear.

In the battle between "old" (bricks and mortar) and "new" (online) retail, few will survive although according to the market, the winner couldn't be more clear.

It was quiet, too quiet. Markets were comfortably drifting ever higher (10th day up in a row for Nasdaq) and then headlines hit on Bloomberg reporting that special counsel Robert Mueller wil be probing Trump's business transactions and will extend his investigation to examining the dealings of Kushner and Manafort.

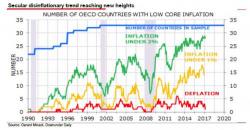

One month after he shared his preview of the endgame of this current centrally-planned economic regime (expect no happy ending there, as "citizens will soon turn their rage towards Central Bankers.") Albert Edwards is out with a new note asking whether "H2 2017 will undo the trend of lower inflation, bond yields and the dollar?" and - if the answer is no - he cautions that "investors might give some thought to the fact that we are now just one recession away from Japanese-style outright deflation!"

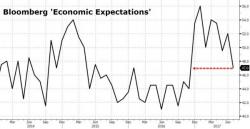

Another 'soft' data survey rolls over...

Following this morning's tumble in the Philly Fed report, Bloomberg's Consumer Comfort survey shows economic expectations plunged back to their lowest since before the election...

The monthly measure of economic expectations fell to 47 in July from 52 in June.

The share of respondents who say economy getting better dropped to 28%; 32% said it was getting worse.

While nobody was expecting much from the ECB's policy statement this morning, with all eyes on Draghi's press conference in 45 minutes, judging by the disappointed market reaction to what were largely canned remarks by the ECB which sent the EURUSD in kneejerk reaction lower, positioning is indeed stretched and unless Draghi comes out with hawkish bazookas blazing, the EURUSD may slide bigly.