New Study Finds U.S. Healthcare System Ranks Dead Last Compared To Other Developed Nations

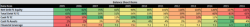

As Republicans sit on the precipice of fumbling what will likely be their one opportunity to repeal and replace America's failed Obamacare experiment, a new study just released by The Commonwealth Fund found that the U.S., despite spending more money per capita than any other country on the planet, has the worst healthcare system in the developed world.