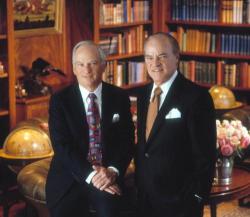

KKR Names Successors To Co-Founders Henry Kravis, George Roberts

Iconic Private Equity firm Kohlberg Kravis Roberts i.e., KKR, has appointed two executives to succeed co-founders Henry Kravis and George Roberts, in what the FT dubs is a "rare move for an industry where succession plans have not been set out publicly."