Deutsche: The Market Broke In 2012, "This Is What Everyone Is Talking About"

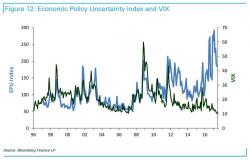

Two weeks after Deutsche Bank’s whimsical, James Joycean derivatives strategist, Aleksandar Kocic disaggregated the market’s current sweeping complacency regime in a florid stream-of-consciousness report, and warning that the market's current "metastability" would lead to "cataclysmic events", with a crash becomes increasingly more likely the longer price discovery in the market (one not propped up by Federal Reserve) is delayed, in his latest note from this week he takes on a more practical - if just as abstract - target; quantifying complacency, both in a market sense and as a metaphysica