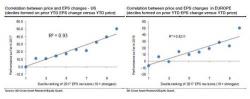

SocGen: "Fundamentals No Longer Matter? Yeah Right..."

Following JPM's calculation that only 10% of trading is fundamentally driven by flesh-and-blood investors, and increasing rumblings that traders now exist at the mercy of machines, many of which respond merely to fund flows and not fundamentals, SocGen's Andrew Lapthorne cross-asset strategist will have you know that he will have none of that nonsense, and in a note that is sure to spark strong reactions across Wall Street, writes this morning that "with all the talk of systematic and passive investment dominating markets and, conversely, the apparently low participation of fundamentally-dr