Steve Saville wrote a post this week, in which he proposed a model that indicates the fundamentals of gold. According to him, these are: (1) the real interest rate, (2) the yield curve, (3) credit spreads, (4) the relative strength of the banking sector, (5) the US dollar’s exchange rate, (6) commodity prices, and (7) the bond/dollar ratio.

We consider him a friend, and certainly appreciate his view that when gold moves from an ETF to China or India, it has no effect on the price. However, we disagree with his fundamental model. Let’s do a quick rundown of these factors and move on to a broader point.

1. The Real Interest Rate.

We have addressed this before, saying:

The Nominal Interest Rate means the rate at which lenders lend and borrowers borrow in the market. The Real Interest Rate is the Nominal Interest Rate – inflation. Notice the switcheroo. The actual rate charged by actual lenders to actual borrowers is dismissed as merely nominal. A fictitious rate which is not used in any transactions is elevated to the status of real. Got that?

This is on top of two other problems. We all learned in grammar school that you cannot add apples and oranges, but economics unteaches that and says you can average apples, oranges, gasoline, and rent. Except economists don’t agree on which prices should be included.

There are many nonmonetary forces pushing up consumer prices, such as taxes and minimum wages. Should one really try to adjust the interest rate every time some economically-illiterate city council decides to hike the minimum wages?

We have written before that there is sometimes a correlation between (nominal) interest and gold prices, such as 1971 through 1980. Interest on the 10-year started January 1971 at 5.5% but by the end of 1980 hit 13.1%, or +138%. The price of gold started 1971 at $35, and hit $880 in 1980, or +2,329%.

However, there are also times of inverse correlation. In 2000, the price of gold started around $282 and hit around $1,900 in 2011. This was a period of falling interest rates, down from 6% to 1.9%.

Depending on whose data you use, the real interest rate trends look similar to nominal, rising rapidly through most of the 1970’s and falling after 1981.

Most importantly, how does interest drive the gold price. And when we say how, we mean: what is the causal mechanism? We don’t see it (nor, by the way, do we believe that any investment necessarily goes up when government drives up costs and prices).

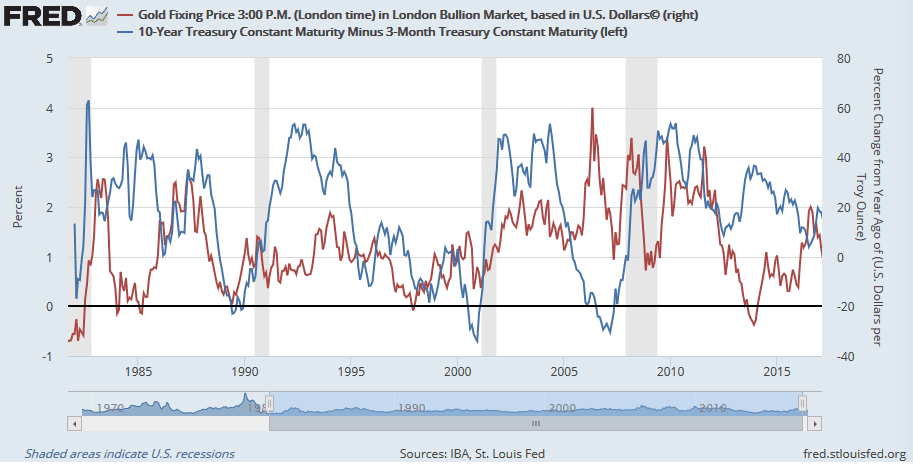

2. The Yield Curve.

This is a very important indicator. It drives many behaviors, and consequently prices, in the economy. This is because when the yield curve flattens, banks’ margins are squeezed. When it inverts, banks are making a negative profit (i.e. loss) but still incur all the risks. Banks may be obliged to sell assets and shrink their balance sheets. If they have a lot of gold, then this could drive the price down. If not, then not.

The yield curve was inverted in the run up to 2008 as we see in the graph below (and inversion lasted into 2009 on shorter maturities), and there was a 30% drop in the price of gold.

We see periods of correlation, as the late 1980’s and periods of anticorrelation, as 2012 through present.

It should be an interesting thing to watch now. As the Fed has been pushing up the Fed Funds rate, the 10-year yield has been falling. It seems likely to us that if the Fed persists on this impossible mission of trying to hike rates then it will cause a yield curve inversion. If that happens, something tells us that this time the gold price will not go down.

3. Credit Spreads.

We assume he means the premium paid by low-quality borrowers above what the US Treasury pays. Like an inverted yield curve, rising spreads mean pressure on the banks.

And like with curve inversion, it depends on how much gold the banks and other leveraged players are holding.

4. Relative Banking Sector Strength.

We haven’t plotted it, but we assume bank stocks will outperform the broader stock market when the yield curve is steeping by way of falling Fed Funds rate. This is when the banks’ net interest margin is rising, and they are getting capital gains on their bond portfolio too. At the same time, credit spreads are narrowing, so the banks are getting capital gains on their junk bonds.

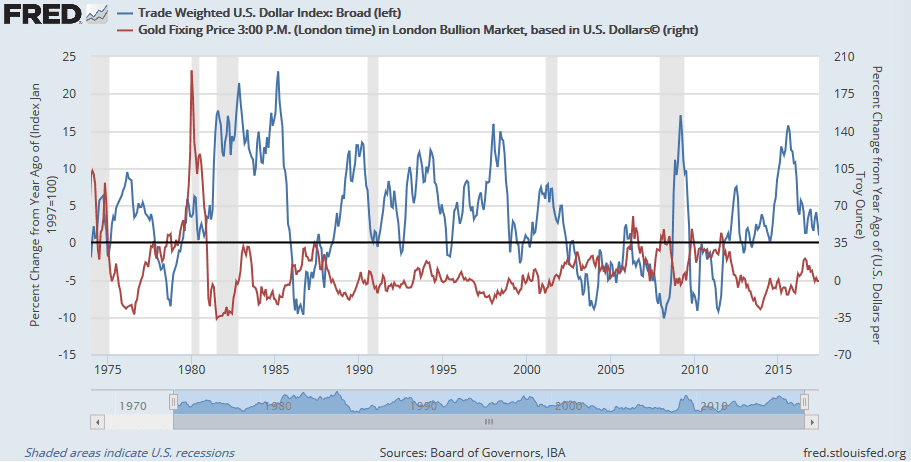

5. The US Dollar Index.

The way the world is supposed to work, according to the Treasury, is every day banks and corporations are supposed to borrow incrementally more, to buy commodities (i.e. inflation), speculative assets (i.e. the wealth effect), and to hire people and expand business (i.e. growth). Many of these speculative assets and businesses, are in other countries so the other currencies go up.

There is an additional bonus for all the dollar borrowers around the world. When their local currencies are rising, repaying dollar loans becomes easier for them. So there is less default risk and the credit system preserves the appearance of soundness for another day.

There are times when this is bearish for the price of gold. After all, who needs a hedge against the financial system when it’s working as it’s supposed to do. And there are other times, when the price of gold rises. Such as 2009-2011, because of fears of inflation.

We are hard-pressed to find much correlation though we see one notable anticorrelation from around 1975-1978.

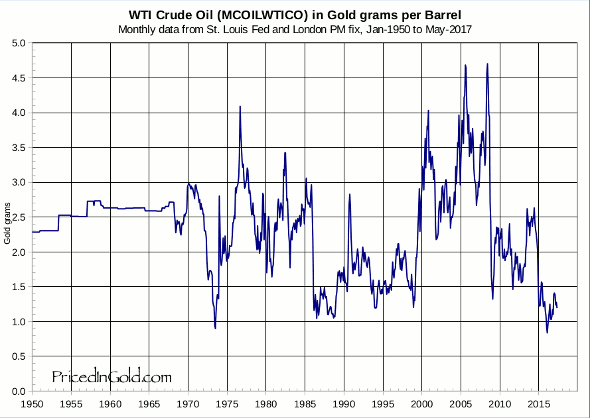

6. Commodity Prices.

This assumes that the price of gold goes up with inflation. At least raw commodity prices are a better measure than consumer prices, which are more subject to more nonmonetary forces.

There is a popular belief—I saw it expressed as recently as Wednesday in my talk on the MM GOFO™ in London—that prices in gold terms are constant, a popular example being that Roman Senators paid the same amount of gold for a toga as a modern man pays for a high-end suit. Therefore by definition, if not by causal mechanism, if the prices of commodities are rising then so too must the price of gold.

For the truth, we encourage everyone to browse Priced In Gold.

To put this in perspective, the price has ranged below 1 gram per barrel to about 4.6g. That is a difference of 460% within an 8-year period.

7. The Bond / Dollar Ratio.

This will go up with falling interest rates and rising currencies. We have said our piece, above.

He states his premise, “gold’s true fundamentals are measures of confidence in the Fed and/or the US economy.”

It is far from clear to us that the price of gold is predominantly driven by confidence in the US. At times, for sure, but sometimes not. We would restate the above premise as “sometimes, the marginal gold market participants are those who worry about the US government / economy / dollar.”

Contrast that with the Monetary Metals fundamental indicator. We are not trying to find proxies for gold demand, nor factors that have correlated. We are measuring gold abundance and scarcity as they exist right now, in the market.

How do we do that? We carefully measure the effect of the speculators who use leverage to buy futures, and back this out of the price. What is left is the price at which metal would clear today. Would clear, if it wasn’t going into, or coming out, of carry trades.

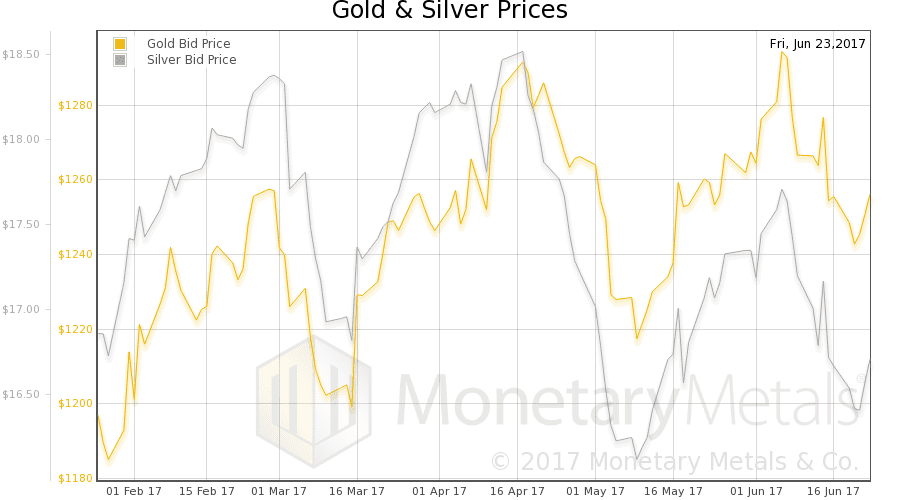

This week, the price of gold was up three bucks, and that of silver 2 cents. The gold-silver ratio fell a smidge.

As always, we are interested in the fundamentals. And by fundamentals, we mean supply and demand conditions measured in the market. But first charts of their prices and the gold-silver ratio.

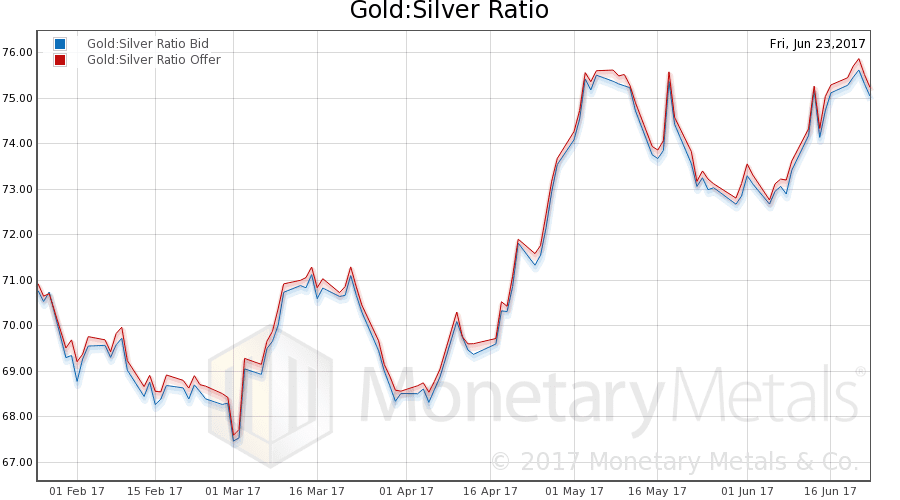

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio.

In this graph, we show both bid and offer prices. If you were to sell gold on the bid and buy silver at the ask, that is the lower bid price. Conversely, if you sold silver on the bid and bought gold at the offer, that is the higher offer price.

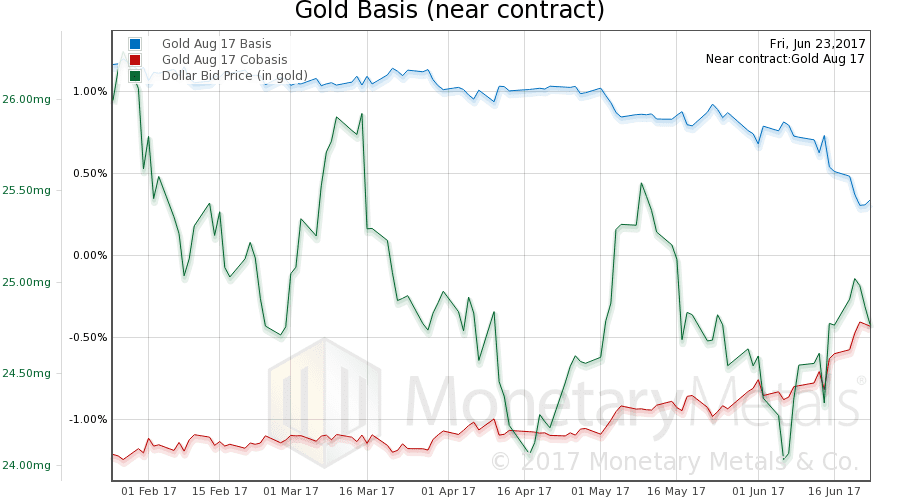

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

We had a slightly falling price of the dollar (the mirror image of the rising price of gold). The abundance rose (the basis) and the scarcity decreased (the cobasis). All by small amounts.

Our gold fundamental price fell about $7 (chart here).

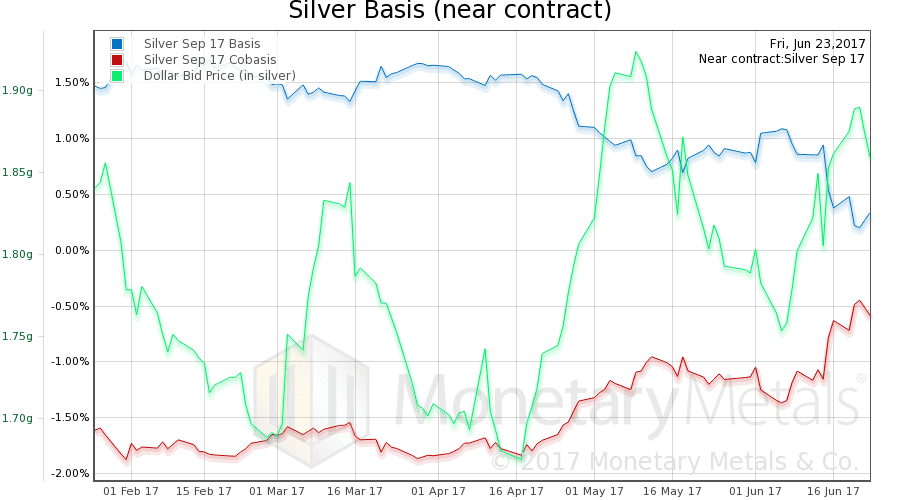

Now let’s look at silver.

The near contract shows a decrease in abundance and increase in scarcity, but the continuous shows the opposite.

Our silver fundamental price decreased $0.22 (chart here).

Monetary Metals will be exhibiting at FreedomFest in Las Vegas in July. If you are an investor and would like a meeting there, please click here.

© 2017 Monetary Metals