Central Bank Intervention Serves The One Percent

Central Bank Intervention Serves The One Percent

Paul Craig Roberts

Central Bank Intervention Serves The One Percent

Paul Craig Roberts

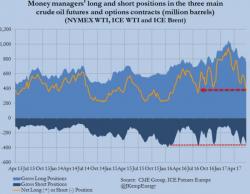

While the fundamental outlook for oil appears weak, with U.S. shale drillers continuing to add extra rigs (despite the downturn in prices), Reuters' John Kemp warns that positioning data suggests the risk of a short-covering rally is increasing.

The hedge fund community placed enormous faith in OPEC’s ability to accelerate oil market rebalancing through cuts announced late in 2016 in association with key non-OPEC producers.

Authored by Valentin Schmid via The Epoch Times,

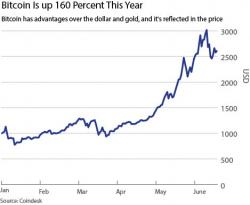

James Rickards, author of “The Road to Ruin,” has successfully predicted Federal Reserve (Fed) policy in the past. In this interview with The Epoch Times, he explains why the recent tightening could lead to a recession and why he recommends gold as a “crisis hedge.” He also explains why he thinks bitoin is in a bubble.

http://content.jwplatform.com/players/1fjLMlxk-jpm2kCrG.html

In the last week, the controversial Hindenburg Omen has started to cluster ominously once again.

Combined with divergent market internals and rates off the zero-bound (and global central bank balance sheets actually shrinking), John Hussman warns of the rising likelihood of an interim market loss on the order of 50-60% over the completion of the current cycle.

As Hussman Funds' John Hussman explains,

The CBO has scored the Senate version of the healthcare bill, which was passed by the House as H.R.1628, and found a few more modest improvements relative to its scoring of the Healthcare Bill as of May 24 . Here are the apples to apples comparisons with the last proposed version of the bill: