"Technology Is Replacing Brains As Well As Brawn" - Challenging The 'Official' Automation Narrative (& Social Order)

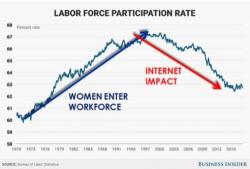

Academics and economists have repeatedly underestimated the impact that immigration and automation would have on the labor market. As data on productivity gains and labor-force participation clearly show, the notion that innovation ultimately creates jobs by allowing workers to focus on higher-level problems is an illusion. If it were true, then why aren’t we already seeing more of the 20 million prime-age men who have inexplicably dropped out of the labor force welcomed back in?