Are Central Banks Getting Ready to Crash the System Again?

While investors pile into Tech Stocks based on endless promotion from the financial media, the US economy is rolling over.

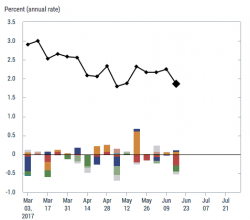

Last week the NY Fed downgraded its economic forecast for 2Q17 to just 1.9%. Even worse, it is now forecasting 2017 total growth to be a measly 1.5%.

Yes, 1.5%.

There is a clear trend to this chart… and it’s NOT up.

Source: NY Fed

Wait, it gets worse.

The Citi Surprise Index has collapsed to levels not seen since 2011.

Source: Yardeni Research

Why does this level matter?