UBS Has Some Very Bad News For The Global Economy

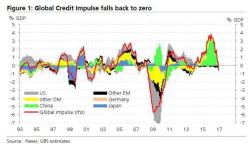

At the end of February we first highlighted something extremely troubling for the global "recovery" narrative: according to UBS the global credit impulse - the second derivative of credit growth and arguably the biggest driver behind economic growth and world GDP - had abruptly stalled, as a result of a sudden and unexpected collapse in said impulse.