CalPERS Slashes Pension Payments To Retirees In Two More California Towns By Up To 90%

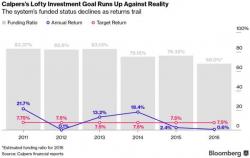

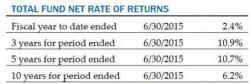

While we've yet to experience any large municipal pension failures, which is just a matter of 'when' rather than 'if', the small pension failures sprinkled across the state of California are starting to pile up. As The Sacremento Bee points out today, public workers in Trinity and Imperial counties are just the latest to have their pensions slashed by up to 90% as their cities admit what most of us have known for some time, namely that they're running ponzi schemes which simply don't have the funding required to payout the benefits they've promised.