The Other Shoe Drops: Prime Auto Loan Losses Surge As Recoveries Tumble

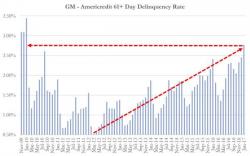

When we looked at subprime auto delinquencies most recently, we found some troubling trends: first, in February, we showed that 61+ day delinquencies in General Motors' subprime securitization book would support a rather bleak thesis for future auto sales, and specifically the demand side of the equation, with January 2017 delinquency rates soaring to the highest levels since late 2009/early 2010.