Who Is The Real "50 Cent" - A Mystery Trader Is Systematically Betting Massive On A VIX Spike

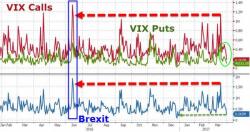

VIX Call volumes had exploded in recent weeks, accelerating to their highest levels since Brexit ahead of the healthcare vote, which saw VIX spike dramatically to 2017 highs.

However, in the aftermath of the pulled vote debacle, VIX collapsed at a near record pace, as did VIX Call volumes (trading at their lowest level since 2016).