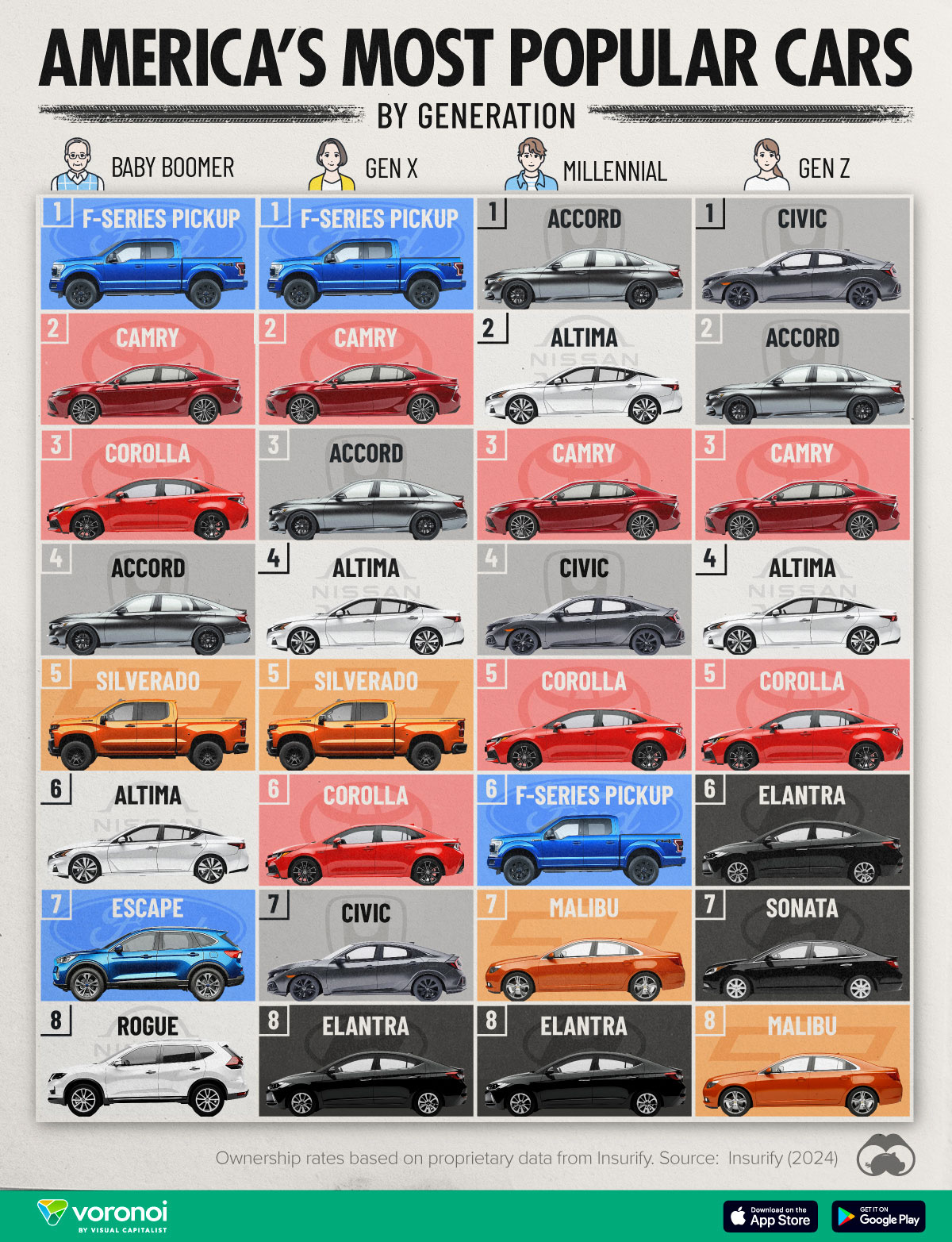

Ranked: America’s Most Popular Cars, by Generation

![]()

See this visualization first on the Voronoi app.

Use This Visualization

Ranked: America’s Most Popular Cars, by Generation

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.