Gold Slips As China Curbs Imports To Slow Capital Flight

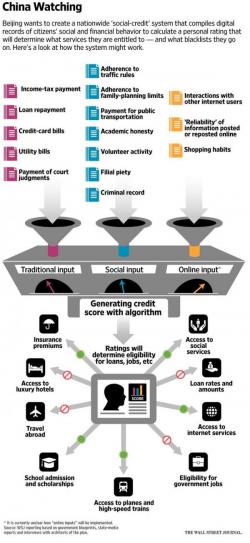

While all eyes were on India (as rumors swirled of an imminent gold import ban), The FT reports that China curbed gold imports in the wake of government attempts to clamp down on capital leaving the country, according to traders and bankers.

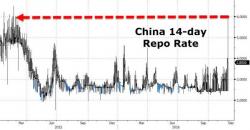

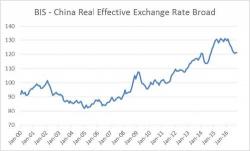

Some banks with licences have recently had difficulty obtaining approval to import gold, they said — a move tied to China’s attempts to stop a weakening renminbi by tightening outflows of dollars, the banks added.