Study Of 10-Year State Pension Returns Highlight Full Extent Of Public Pension Ponzi

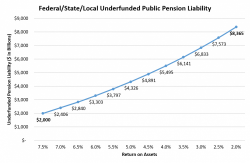

A new study of public pension returns by Cliffwater LLC has found that the median U.S. state pension plan returned just 5.9% annually over the 10 years ended June 30, 2016. Meanwhile, as Pension and Investments notes, the top performing state pension, the $15.6 billion Oklahoma Teachers' Retirement System, was the only fund that managed to eek out a return over 7% during the same period.