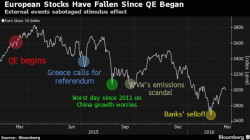

Global Markets Surge After Traders "Reassess" ECB Stimulus

Three months ago, on December 4, when the ECB clearly disappointed markets and European stocks tumbled as the Euro soared, it took a speech by Mario Draghi at the Economic Club in NY to send stocks soaring...