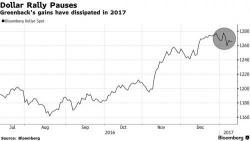

Dollar Falls On Fading Trump Euphoria; Sterling Slide Spikes UK Stocks; US Futures Flat

Global stocks were fractionally lower in early European trading, closed Asia mixed, while S&P futures were unchanged, as the dollar fell for a second day on concerns ahead of Trump's press conference on Wednesday. Oil rebounded after its Monday plunge, while commodity metals like iron ore rose limit up in Chinese trading. Top overnight stories include Valeant announcing the sale of $2.1 billion in assets to pay down debt; VW managers warned to stay in Germany as U.S. charges near; Yahoo! plans to shrink board, get rid of Marissa Meyer and change its name after Verizon deal.