Bonds & Bullion Bounce But Banks Bruised As Dollar Dumps

Interesting day...

Bonds & Bullion now outpacing stocks post-Fed... (and bank stocks are down 1.6% post-fed)

Interesting day...

Bonds & Bullion now outpacing stocks post-Fed... (and bank stocks are down 1.6% post-fed)

One day after the biggest drop in US stocks in over two months, taking the Dow ever further from the "promised" Dow 20000, global stocks struggled as they tried to close out 2016 on a positive note. The dollar dropped the most in two weeks, sliding alongside bond yields, while oil retreated from its highest close in 17 months as investors prepared to close out a volatile year for financial markets. European stocks slid from a 2016 peak, and extended losses for 2016 after briefly going green for the year.

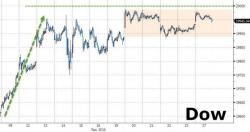

For 10 straight days, progonosticators have promised that the Dow Jones Industrial Average will break gloriously above 20,000 for the first time in history, proving how great the economy must be (or will be) and leading investors to the next secular bull leg of this miracle of wall street.

So far it hasn't happened... (Dow +11.75% post-Trump)

But halfway around the world, Chinese fears (of capital controls and devaluation) have sparked an exodus into alternative currencies - most notably Bitcoin as it soars towards $1000. (BTC +42% post-Trump)

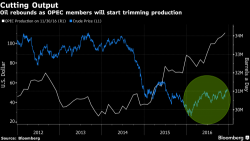

Global markets continued their levitation with the UK returning from vacation, pushing the MSCI Asia Pacific Index higher for the first time in seven days, while oil headed for the longest winning streak in almost seven years ahead of the promised OPEC production cut which is set to begin in just days.

Most world markets have reopened following the holiday weekend, but trading volumes remain significantly muted. Asian and European shares advance modestly amid low volumes with U.K. and Ireland closed; S&P futures are little changed while the dollar rose and oil extended its longest winning streak in four months.