The Week's Key Events: European Inflation, US CapEx And Non-Stop Fed Speakers

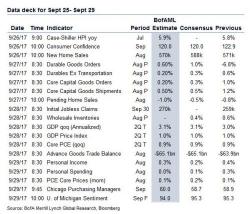

Beyond the plethora of central bank speakers, market focus will concentrate on Eurozone inflation and US data releases, including durable goods, home sales, and the personal income and spending report on Friday. We also get China PMIs, Japanese CPI and industrial production, the RBNZ meeting and Brexit negotiations (4th). Additionally, there will be monetary policy meetings in Mexico, Colombia, Czech Republic, Thailand and Egypt.