Ray Dalio: The Central Bank Era Is Ending "So Let's All Thank Them"

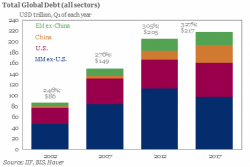

For some inexplicable reason, Ray Dalio still thinks the the world not only underwent a deleveraging, but that it was "beautiful." Not only did McKinsey prove that to be completely false two years ago, but for good measure the IIF confirmed as much last week, when it revealed that global debt has hit a record $217 trillion, or 327% of GDP...

... while Citi's Matt King showed that with no demand for credit in the private sector, central banks had no choice but to inject trillions to keep risk prices from collapsing.