It's Not Just Americans, Europe's New Obsession With Auto Leases Is "Catastrophic For Used Car Prices"

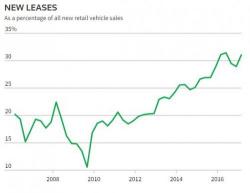

We've spent a lot of time of late writing about the pending collapse of the U.S.

We've spent a lot of time of late writing about the pending collapse of the U.S.

Via The Daily Bell

Germany has taken its war on “hate speech,” also known as free speech, to the people.

Already Germany has pretty strict laws against citizens using Nazi symbols and denying that the Holocaust happened. Apparently, lawmakers miss the irony of going full Gestapo on citizens for free speech, as offensive as it may be.

But they are not stopping there. The German government has raided the homes of 36 people accused of hateful posting on social media.

Authored by Daniel Lang via SHTFplan.com,

Most people inside and outside of the US believe that this country’s gun ownership rate is unique, but that’s not exactly true. Though America has the most privately owned guns per capita, there are other countries that aren’t too far behind us, such as Serbia, Yemen, Cyprus, and many Western nations like Finland and Switzerland. In most cases, these countries don’t have access to the same kind of firearms that we do, but nonetheless there are a ton of guns floating around in these places.

Authored by Paul Craig Roberts,

For sixteen years the US has been at war in the Middle East and North Africa, running up trillions of dollars in expenses, committing untold war crimes, and sending millions of war refugees to burden Europe, while simultaneously claiming that Washington cannot afford its Social Security and Medicare obligations or to fund a national health service like every civilized country has.

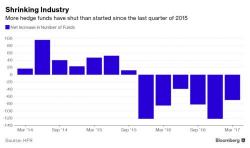

The hedge fund industry is finding itself in increasingly dire straits as persistently weak returns and the advent of low-cost investing have forced more and more funds to shut down. So, it's unsurprising that, amid this steadily worsening backdrop, more traders are heading for the exits. But where are the heading? Increasingly, more traders are moving back from where they came - i.e. the big banks, which expect to see a boost in trading revenue as President Donald Trump has vowed to dial back postcrisis regulations that forced banks to wind down their prop desks.