Europe's Blinkered Leaders: Shielding Themselves From Reality Again

Authored by Judith Bergmann via The Gatestone Institute,

-

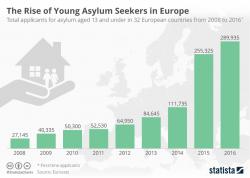

Shielding heads of state from seeing the consequences of the policies that they themselves have forced on the entire European continent represents a staggering new level of hypocrisy.