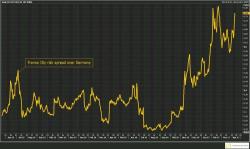

French Sovereign Risk Soars To 5 Year Highs As Election Looms

With the rise of communist candidate Melenchon throwing the French election results into disarray for the status quo supporters, it appears traders are rushing headlong for the safety of core-core Europe and rapidly exiting anything to do with France.

As reported in our overnight wrap, the recent surge in far-left candidate Melenchon has changed the French presidential election calculus materially in recent days, sending the spread between French and German 10Y blowing out again, helped by yesterday's Goldman downgrade of French OATs.