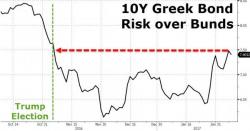

Germany Rules Out Greek Debt Cut: "For That It Would Have To Exit The Currency Area"

With the IMF and Germany again at each other's throats over the neverending drama that is Greece, German Finance Minister Wolfgang Schaeuble repeated the same line he has used since the third Greek bailout from the summer of 2015, and in response to the IMF's demands for a reduction in Greek debt and fiscal surplus, the German ruled out a debt cut for Athens "as a violation of European rules", adding that "the country would have to leave the euro area to do so."