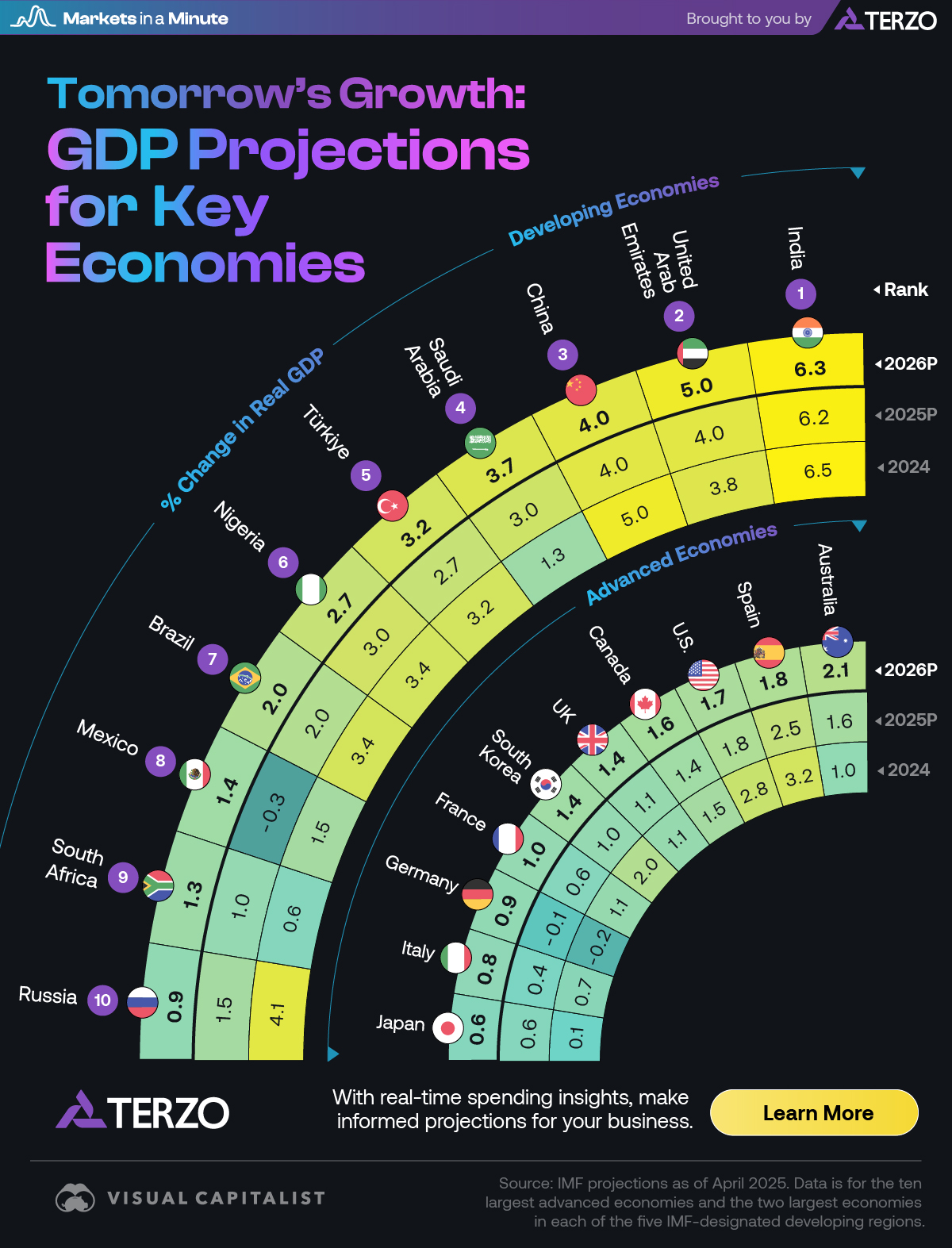

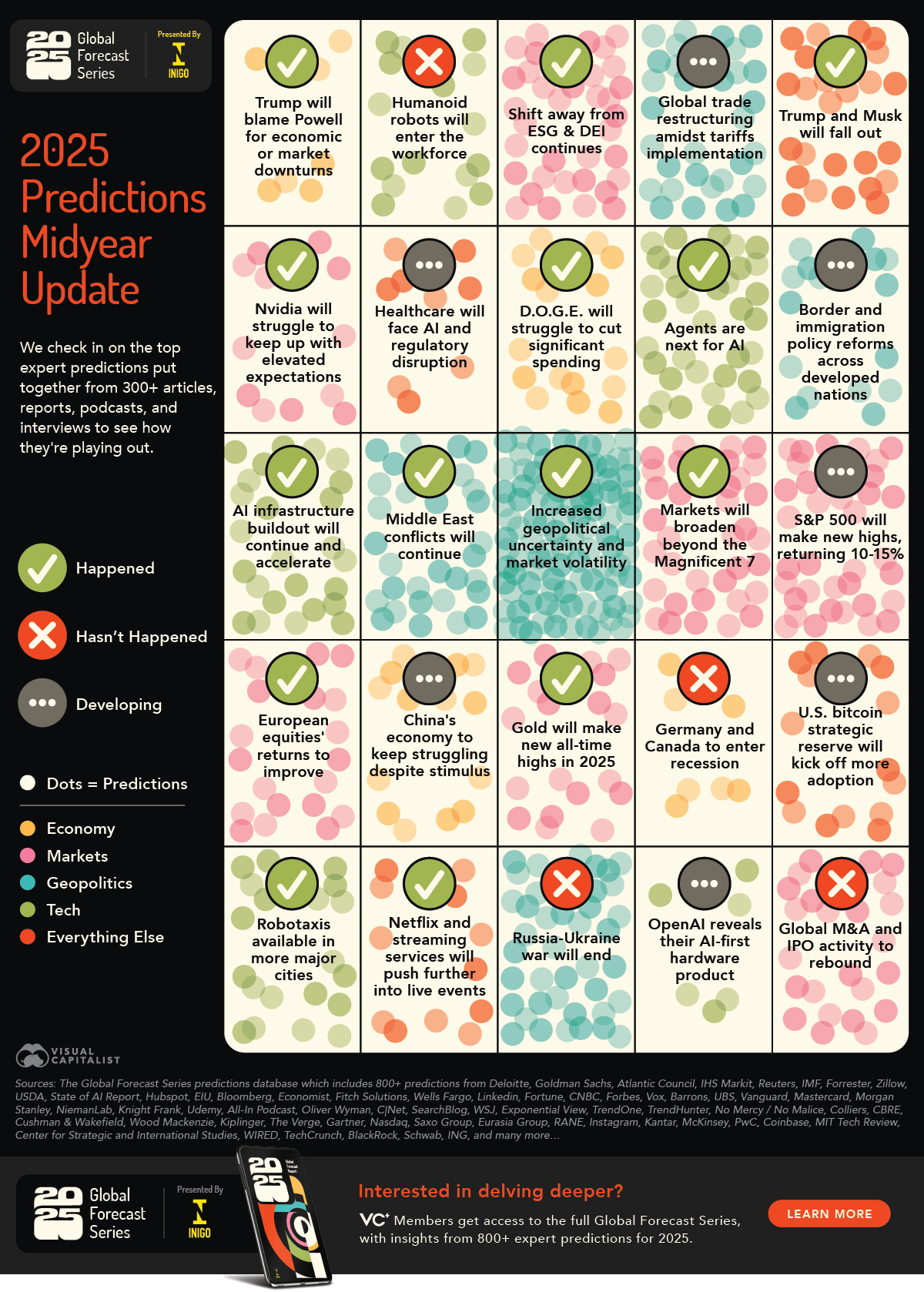

Prediction Consensus: 2025 Midyear Update

This article is an excerpt of a members only VC+ Special Dispatch. Join VC+ to unlock the full analysis.

Use This Visualization

Prediction Consensus: 2025 Midyear Update

Each year, our editorial team at Visual Capitalist sifts through hundreds of reports and articles to put together our Prediction Consensus, an aggregation of everything that experts predict for the year ahead.