Key Events In The Coming Pre-Holiday Week

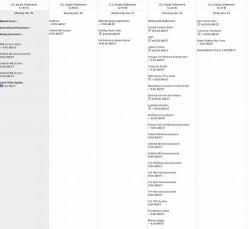

The key economic releases this week are durable goods and GDP on Thursday. Chair Yellen’s speech on the labor market on Monday afternoon is also likely to garner considerable attention. While the calendar gets quieter in the weeks ahead over the holiday season, there are a few notable macro events to keep traders occupied.

This week, the Bank of Japan and Riksbank deliver their latest policy verdicts, and we also get the RBA Minutes, while in the first week of the new year attention turns to FOMC Minutes and NFP, as well as Eurozone inflation.