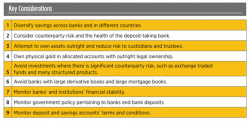

Bank Of England Warn Of "Challenging" Outlook For Britain's Financial System

Ulster Bank Parent RBS Fails Bank of England Stress Test

"Royal Bank of Scotland (RBS)(RBS.L) will cut costs and sell assets to boost capital levels, it said on Wednesday after failing this year's Bank of England stress test, which warned of a "challenging" outlook for Britain's financial system.