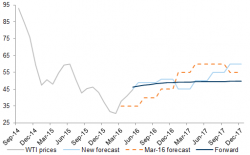

Futures Flat Despite China Scare As Oil Rebounds Over $47

The main risk over the weekend was that markets, which have now dropped for three consecutive weeks the longest negative streak since January, would focus their attention on the latest batch of negative Chinese economic news released over the weekend, which missed expectations across the board, most prominently in Retail Sales (10.1% vs. Exp. 10.6%, down from 10.5%) and Industrial Production (6.0% vs. Exp. 6.5% down from 6.8%), and following Friday's disappointing new credit loan data, would sell off as the Chinese slowdown once again becomes a dominant concern.