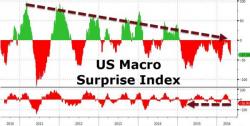

Stocks Up, Bonds Up, Credit Up, Commodities Up, Dollar Up... Volume Down, Economy Down

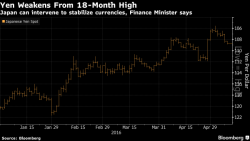

Yeah ok - the best day in US equities in 2 months... on what? Data has been crap (even JOLTS 'good news' does nothging but corner The Fed into rate hikes even more), earnings have done nothing, bonds are rallying, and oil rallied on the back of a surge in production (perhaps front-running API inventory data)..."it's all good" up here right?